There has been a lot of talk on the impact of Coronavirus on Mumbai’s real estate market. I have been attending multiple webinars hosted by NAREDCO, MCHI and many prominent developers over the course of last few weeks. It is interesting to see that most experts are portraying.

→ Developer Margins

It is not a secret that Mumbai’s real estate industry has seen stagnation in the last few years. There has been no stability since 2011. At regular intervals, there have been huge changes in state real estate policies. Taking it back to 2011, the definition of Carpet Area was changed. In 2016, we had Demonetization followed by the induction of RERA and GST in quick succession. Stamp duty on property purchase was increased. Every year the Ready Reckoner rates increases. The BMC charges more and more premiums on new projects. The DCR rules keep changing. Real estate funding has dried up with banks under stress. NBFC’s do not fund developers anymore. There are unseen factors, change in government policies and red-tapism causing undue construction delay. These delays do not stop the interest ticker. On top of all these, we have exorbitant land prices in Mumbai. All of these factors have eaten up the margins of developers.

New construction project feasibility is simply not there anymore. It is a monumental task to construct in Mumbai. Developers are burdened, financially as well as mentally. Most projects are stalled or do not take off as it is not viable, even at cost price. Upcoming builders take up projects even if they make 10% profit, just to make a name for themselves. Reputed developers will not take up projects below 20% profit margins. Generational developers are surviving due to projects they had taken years back or are sitting on land banks purchased decades ago. These projects have just now become feasible. Developers have taken most of the burden on their heads to stay afloat. There is no room left for price reduction. No wonder more and more developers are simply giving up and walking out of projects.

→ Expect A Correction in Mumbai Real Estate Prices

I had attended the webinar where Mr. Deepak Parekh, Chairman of HDFC mentioned that real estate prices have to and must go down by 20%. That’s a huge number for Mumbai real estate. The total of stamp duty and GST paid for apartments in Mumbai is sometimes equal to the value of a 2 BHK flat in Pune. Maybe in lower tier there might be scope of reduction, but in Mumbai 20% goes in Lakhs and Crores. Yes, there will be scope of negotiations in resale properties. Sellers who had purchased their property 20 years back will definitely slash their prices by 20% to 25%. For them the goal is to sell and get out. Resale flat sellers have been sitting on the property for years, expecting a price which is not realistic. It’s only after years of delay, they realize how much time has been wasted trying to achieve the impossible. So yes, you will get the so called discount deals in the resale market.

Case Study

In 2017 my client was asking 8 Crores for their 1,400 sq.ft. 2 BHK + 1 BHK Jodi Flat in a 20+ year old building in Juhu. I advised them that they were overpriced and should not be quoting more than 6 Crores with a 5% to 10% margin for negotiations. Cut to early 2020, the sellers got fed-up and eventually sold the flat for just over 5 Crores. From a buyer’s perspective, he got a deal. The seller’s perspective, sold way below market value. My perspective, it sold for what it deserved.

In OC ready new construction ready to move in flats, there will be some scope of negotiations. The developer is sitting on inventory which needs to be liquidated. It makes no sense for him to hold on to ready inventory. On the other hand, discounts won’t be phenomenal in ready to move properties. OC ready to move in apartments are the least risk and most demanded flats. If one buyer does not take it them someone else will. Developers have started giving lucrative offers during the lockdown period to keep their cashflow. This will push the wait-n-watch buyer over the line to finally make that leap. There is a possibility of a bidding war in these flats. As a buyer, you should not expect ridiculous discounts.

→ Survey

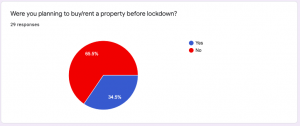

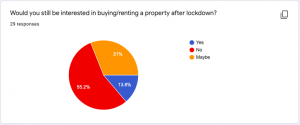

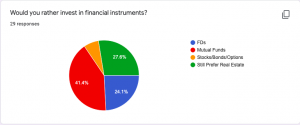

I did a survey of a small sample of my clients. Here is the result! You can judge on your own. Almost 60% of the people surveyed still think that real estate is a safe investment and more than 25% of the people would prefer real estate investments after lockdown over other financial instruments.

→ Buyer Sentiment

Everyone has been stuck inside their home during the lockdown. Everyone will be reassessing their current accommodations. Whether they have sufficient space for the family? Are they happy with their home? Would it be better in a building with amenities for the child? Are we safe in our flat and building? Are my neighbors there to support and help me? Everyone will be rethinking. Some will come out happy with their homes. Some will feel the need to downsize. Others will understand that their home is not big enough for the family and that it is time for an upgrade. Buyers who are hesitant to make the decision will realize if they have to purchase a new home or not.

→ The NRI Equation

NRI’s have experienced a tragedy, whether in USA, UK, GCC or Southeast Asia. They will be resurfacing into the market again to purchase properties. NRI’s have an emotional attachment to their home base. They face various uncertainties in foreign lands. They always want a backup plan. NRI’s always turn to their homeland as a final resort. At the end, they need to safeguard their retirement. They need to safeguard against any untoward immigration issues they might face. NRI’s need a fall back plan, which can be only fulfilled in their homeland. Moreover, the current foreign exchange rate gives them more bang for their buck. They will re-enter the real estate market.

→ What Are Future Predictions on Mumbai Real Estate?

I don’t think anyone can accurately predict the future. Although what you can predict are possible scenarios considering the buyer sentiments and your actual ground roots experience. Expect booking cancelations and commitment back outs. Expect renegotiations on already confirmed deals. Employees are unsure whether their jobs are confirmed. There are pay cuts all across the board. Businesses have been hit hard. Cashflow is negligible. Business patterns will have to be changed. People are going to hold on to their savings more dearly than before. The situation is gloomy, grim and nobody knows when this dark phase will end. There is unpredictability, uncertainty and anxiety.

In all of this, I vehemently believe that it is a great time to buy. The first time buyer, the side liners and the seasoned investor should capitalize on this opportunity. There will be intent and there will be sentiment. Yes developers are cash starved and will need working capital. Yes, they have inventory which needs to be off loaded. Yes they have loans which need to be repaid. Everybody knows this and everybody will want to cash into this. There will be a rush in purchase of properties. Deals will be made, discounts will be given. Sellers holding on for years and months will let go. Developers will capitalize on the opportunity. They will sell to reasonable offers and qualified ready funds buyers.

It will be like Christmas, where there will be discounts to be given and deals to be made. The buyer and the seller, both will emerge happy.